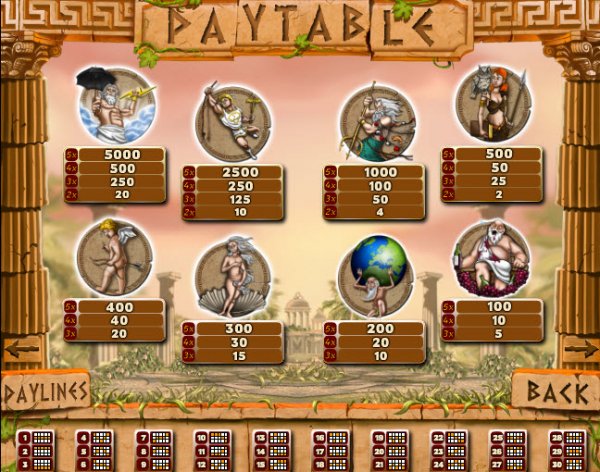

There are no income taxes on Canadian lottery winnings for Canadian citizens. Canadian tax authorities do not consider lottery earnings to be taxable for purposes of Canadian income tax. Winners are required, by American law, to report their tax earnings to American authorities. Unfortunately the casinos are required to withhold a 30% gambling winnings tax on certain gambling winnings. The good news is that for Canadians and some other international citizens. Casino Tax Recovery can help you recover this casino winnings tax. Often the full amount may be recovered with a US Tax Recovery service. Casino Tax Recovery will. If you get a 1099 for Gambling winnings, the IRS will allow you to write off any gambling LOSSES up to that amount. So, for 2015, if you won 10,000, got a 1099, and took a vegas trip and lost 10,000, you would have a zero tax liability on that amount. If you're a Canadian gambling in the United States it's really important to understand the rules around taxes. That's because when you win, you may be subject to a 30% withholding tax on your winnings. Canada and the US have a special tax treaty that includes the IRS taxing Canadians who win money gambling in America. It’s safe to say that a person in Canada winning a lottery prize or winning at a game of pure chance (e.g., craps, roulette, or slots) is not subject to Canadian income tax on those receipts and, in fact, no modern reported case that I am aware of has found such receipts to be taxable.